The State of the Diamond Market in 2024

12 Minute Read

When one discusses the diamond market, there are quite a few individual niches which each have their own trends. Firstly, you have the relatively new world of laboratory grown diamonds. This category may be young, but it is the primary driving force behind much of the change seen across the industry.

Next are natural colorless diamonds. This is the largest of the subgroups and it certainly gets the most attention in terms of efforts towards the standardization of pricing.

Thirdly one can observe oddball colorless diamonds. Examples of gems that fall into this category include stones with noticeable clarity characteristics and those that have been minimally processed or left entirely raw.

Lastly comes the world of fancy-colored natural diamonds. Depending on the color, fancies can be a great deal rarer than the colorless variety, and some come for only a few mines.

These four subgroups of the diamond market have their own environments, but they can and do affect each other. Dealers at the AGTA and GJX shows at the February Tucson show offered some reflections on this dynamic marketplace.

Laboratory Grown Diamonds

Lab grown diamonds are a controversial topic amongst dealers and consumers alike. Some hail them as an ingenious discovery that allows more people than ever before to own and enjoy diamond jewelry. Others say that they devalue natural diamonds and take away from the magic of stones made by the Earth. Whatever your opinion, synthetic diamonds are popular and definitely here to stay.

Siddhant Shah, Director of Adornet Jewels, a company that specializes in conflict-free, lab grown diamonds, spoke to me about the immense growth that he has observed in the synthetic diamond market in recent years. He sells everything from engagement rings to eternity rings, fun fashion jewelry, and more. Mr. Shah said that his customer base doubled last year, and he expects a similar expansion in 2024. His jewelry is often priced between $500 - $10,000 and he says that the $500-$2,000 range is selling the fastest. He stated that his business "has climbed a lot across the board".

Anna S. Lipaygo, a sales representative of Lab Grown Diamonds USA LLC, shared a similar sentiment. Her wholesale and retail clients are buying up all of her synthetic inventory ranging from melee size up to multi-carat weights. She stated that the per-carat prices for her lab-grown gems are mostly stable, but she has noted a slight decrease. In terms of technological development in the world of synthetic diamonds, this makes sense. The machines and methods used to grow diamonds advance each year, becoming more efficient and affordable. It is not unexpected for the prices of these to continue to decrease.

Karan Jhaveri of Diamantra reported that his company sells mostly natural diamonds, but he has stocked synthetic material from India for the last few years. He reported a sharp decrease in the per-carat prices of lab grown diamonds since he began selling them - "the number of stones that we sell grows every year, but our volume is the same because prices are down."

Silversmiths Inc. is taking the same action. Representative Mimi Luo reported that they have begun selling lab grown stones this year due to popular demand. "People are asking for labs because the price is so competitive compared to naturals".

Natural Colorless Diamonds

The availability and affordability of lab grown diamonds has undeniably influenced the natural diamond market. What makes this issue complicated is that, except for the origin, it is the same product. Lab grown gems have all of the same qualities as naturals, but are cheaper. Way cheaper. When dealers present to someone two products where one is of notably better quality and larger in size yet cheaper than the alternative, it turns out that many buyers are choosing the more affordable, better-quality stone.

In response to this, natural diamond sellers need their inventory to be priced as competitively as possible with synthetics. Of course, there is only so far down you can push the prices of natural gems when the whole industry is based on a globally accepted pricing system. However many recognize that they need to make adjustments as much as possible.

Mr. Jhaveri said that he has observed a general decrease in the per-carat costs of natural diamonds weighing over a carat, while values for anything smaller have remained about the same. However, he did make an interesting point about the type of customer who chooses to buy natural gems. He says that he has "pro-natural clients" who do care about the origins of their diamonds. It is thanks to people like this that keeps Mr. Jhaveri optimistic about the future of natural diamonds.

House of Diamonds, Inc. sells both colorless and fancy-colored natural diamonds. Ari Jain, a representative for the company, had some very interesting insight into the current marketplace. He has noted that the global economy for diamonds has become unsteady due to multiple high-profile wars. Russians, Ukrainians, and Israelis, he said, used to be among the top diamond buyers worldwide. Being involved in bloody conflicts has had a strong impact on how many of their citizens choose to spend their money. "Russians, in particular, were buying big diamonds but they have stopped with the war."

I asked Mr. Jain his thoughts about the synthetic diamond market and how he anticipates it will affect the natural gem in the near future, and his answer was fascinating. He said that he has seen wholesale per-carat prices for sizable diamonds beginning at $25. This, he predicts, "will turn buyers away from synthetics" because they will see that the stones, while undeniably beautiful, have such low monetary value.

David Hess and Iris Kentov, representatives of I. Morgenstein also are optimistic that natural colorless diamonds will continue to have their place. They refuse to sell lab grown gems, stating "Synthetic stones are against our principals…we don't want them around our natural inventory in case they become mixed with each other (and we can't separate the stones)." This comment references the increasing difficulty in identifying and sorting synthetic diamonds from naturals. According to industry professionals, there is not a single type of diamond-testing machine that can identify all types of synthetic diamonds all the time. Like Mr. Jain, Mr. Hess and Ms. Kentov believe that the incredibly low per-carat values of synthetics, and even lower re-sale values, is what will end up driving buyers back to naturals. "People don't know what to do with labs. (Buying them) is throwing your money away. Trends come and go, hopefully, labs will go."

Oddball Natural Colorless Diamonds

While some people like Mr. Hess and Ms. Kentov have understandable concerns about the identification and separation of natural and synthetic colorless diamonds, consumers seem to have come up with one adaption in response to this - the rising popularity of salt-and-pepper diamonds and those that are off-color, and/or raw or minimally processed. Lab grown stones are often perfect and affordable, leading some to accuse them of being boring. This is something no one can say about what some label "oddball", "misfit", or "rustic" diamonds.

The process of synthesizing diamonds involves a lot of heat and pressure exerted on carbon in a very short period of time, sometimes as little as several days. With such an extreme environment, any gems with even moderate clarity characteristics that compromise the integrity of their crystal structure can't survive. This is why growers can't make salt-and-pepper stones which have so many large eye-visible inclusions.

In terms of diamonds that have strong contributions of yellow, brown, or gray with color grades in the middle or towards the end of the alphabet, growers are not producing these gems because they already have low per-carat values. The goal of diamond growers is to create gems that are bigger and better, so no one is interested in manufacturing gems that are considered low to middle-quality and don't have high value in the first place. Additionally, synthetic gems are often expertly faceted to achieve the ideal proportions, they are not left in their raw form or only partially cut. If you see a diamond with a lower color grade that is either not cut or has only a few fundamental facets, it is likely natural.

This unique niche of the diamond market featuring highly included/off-color stones is not new. Designers have been producing jewelry with such stones for many years, but the market has recently grown exponentially.

Bjorn Salt & Pepper Diamonds is a company that sells salt-and-pepper diamonds exclusively, something owner Bjorn Halpern is very proud of. He reports that his unique gems "are selling like crazy" and is confident in the sustainability of his niche thanks to the fact that diamond growers can't make salt-and-peppers, and wouldn't want to anyway thanks to the already low per-carat costs of such stones.

OM Imports Inc. is another company that sells salt-and-pepper diamonds sourced from Canada, Belgium, and Africa. Adi Bhatt explained that the cut of each gem is dictated by their one-of-a-kind internal characteristics. What results are diamonds that are each truly unique. Mr. Bhatt was pleased to say that every person who buys one of his company's diamonds owns something that no one else in the world has.

Natural Fancy-Colored Diamonds

The last of the four subgroups is the category of natural fancy-colored diamonds. This group may have a relatively small number of diamonds, but the diversity among the gems is unrivaled. For example, yellow and brown diamonds are relatively common while only a few dozen untreated red diamonds exist in the whole world.

Vidhi Patel of A One Gems Inc., a company that sells both natural fancy-colored diamonds and treated fancy-colored diamonds, gave a wonderful insight into how per-carat values have behaved in the last year and what colors have seen selling the best. In terms of yellow diamonds, Ms. Patel said that her customers generally prefer darker cognac colors over gems with lighter tones and the per-carat values have remained steady in the last year.

She also has treated pink and green diamonds and says that these gems with pastel colors sell better than those with saturated color expression. She attributes this to people wanting diamonds with a more natural appearance over artificial color expression that is too strong to be realistic.

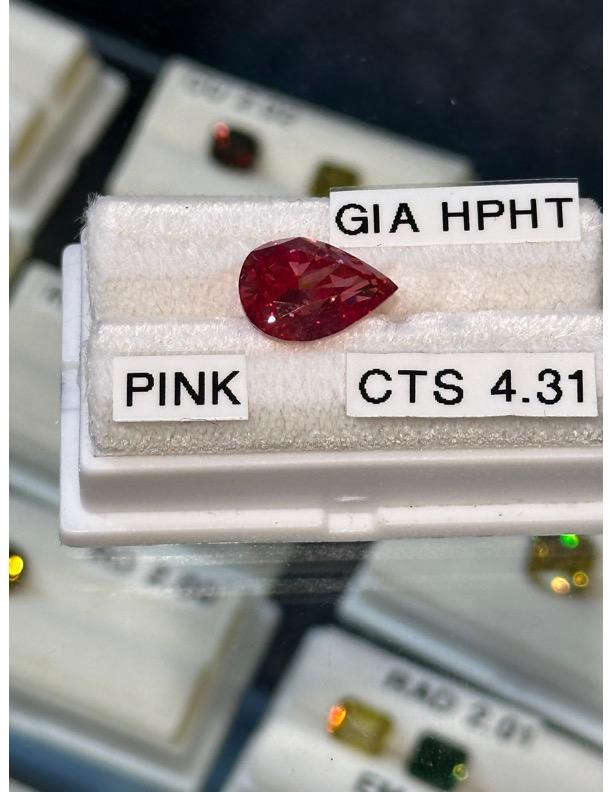

Also worth noting is that Ms. Patel is very proud of her treated pink diamonds. She spoke about how only high-quality gems can survive the HPHT treatment necessary to trigger a pink hue. Similar to synthetic growing processes, the HPHT treatment involves lots of heat and pressure that included or fractured stones can't withstand. She says that her treated pink gems have very good clarity and most started as GHI colorless diamonds.

Shalika Chordia of Galaxy USA, Inc. also sells fancy-colored diamonds. She reported that prices for rare natural pink, blue, and yellow diamonds are holding steady. However, she has seen values for gray and brown stones decrease. Speaking about the colorless market, Ms. Chordia provided the same information as given by the other dealers questioned for this article, that values are remaining relatively stable.

Lastly, Mark Tremonti, the owner and director of Tremac Pty. Ltd., a company that sells only natural diamonds, spoke about the current state of the fancy-colored diamond market. While these gems are cost-prohibitive to most, he said that "the market for fancy color gems is booming regardless."

Mr. Tremonti spoke about the closing of some of the most abundant mines in the world in the last few years. First, he spoke about the Australian Argyle mine, perhaps the most famous diamond mine thanks to it being the primary source of pink and red diamonds worldwide, as well as producing limited amounts of other colors. Now that the mine has been closed for several years, Mr. Tremonti said that there simply is no pink rough left to be had at any price point despite continued demand. Such diamonds are simply not consistently found anywhere else in the world. Anyone who wants a pink diamond that isn't lab grown must go to a company like A One Gems Inc. that has treated gems.

Mr. Tremonti also made the point that the closing of Argyle also affected the supply of chameleon diamonds. Such gems are rare, and the number of people interested in purchasing them is few, yet they are a passionate group. However, Mr. Tremonti said that no one really knew where the diamonds on the market came from. Now, with Argyle closed, he explained that the supply of chameleon diamonds has suddenly dried up. This, he feels, is no coincidence.

Lastly, Mr. Tremonti also discussed a lesser-known Australian mine called the Ellendale which is not far from Argyle. Ellendale, which closed in 2015, doesn't have the recognition that Argyle did, but Mr. Tremonti explained that this mine was responsible for producing about 40% of all the large fancy-colored yellow diamonds uncovered annually. In fact, he said that yellow diamonds coming from the Ellendale were so spectacular that the mine had an agreement with Tiffany & Co. for the right of first refusal for a while. With this mine closed, the supply of large fancy yellow gems has been affected.

Conclusions

Considering all of the information gleaned at the Tucson shows, a few trends have emerged about the various facets of the diamond market. First, synthetic diamonds are being grown and sold in ever-increasing quantities. Their quality gets better every year as their prices plummet. Some of the prices in the natural diamond market may be decreasing for smaller stones in response to this, but the change is subtle. Truly, the way that the global diamond market is set up, per-carat values can't drop dramatically.

While the popularity of lab grown diamonds continues to increase, there are still many people choosing to pay more for natural diamonds. Also, perhaps in response to the flawlessness of synthetics, the demand for unique natural diamonds has spiked with customers searching for gems as distinctive as they are.

The world of fancy-colored diamonds remains strong, yet the availability of pinks, reds, chameleons, and large yellows has been affected by the closing of the Argyle and the Ellendale mines. Lastly, there is another option for individuals looking for natural fancy-colored diamonds who can find treated gems whose color presentation has been created/enhanced by various treatments like HPHT method. Although the hue expressed by these gems has been altered by humans, it is still a natural diamond.

Emily Frontiere

Emily Frontiere is a GIA Graduate Gemologist. She is particularly experienced working with estate/antique jewelry.

Related Articles

So You Wanna Cut Something New? Gem Faceting Advice

Graves Faceting Machine

Fancy Colored Blue Diamond Buying Guide

Orthoclase Facet / Faceting Information

Latest Articles

800 Years of Mogok: A Celebration in Tenuous Times

What is the Average Gemstone Faceting Yield?

Pyroxmangite Value, Price, and Jewelry Information

How to Identify Emerald Simulants and Synthetics

Never Stop Learning

When you join the IGS community, you get trusted diamond & gemstone information when you need it.

Get Gemology Insights

Get started with the International Gem Society’s free guide to gemstone identification. Join our weekly newsletter & get a free copy of the Gem ID Checklist!